Source : Kitco News | GOLDCeylon

The health of the U.S. economy is becoming increasingly muddled as the service sector continues to lose momentum, according to the latest data from the Institute for Supply Management.

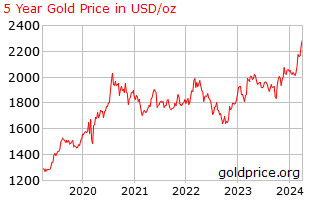

Usually, gold and equity market returns have an inverse relationship – if equity delivers good positive returns, gold prices are muted. However, at present, the stock market and the gold price are at an all-time high. The price of yellow metal is not only increasing in India but across the gold. The gold prices in the US hit an all-time high above $2,286.

The gold price is up 38% from its last low point in 2022. Even in India, Sri Lanka with the start of the new financial year, the gold price has crossed a new milestone. In this article, our focus will be to understand why the gold prices are increasing and what will be its overall impact.

Why are gold prices increasing ?

Here are some reasons for the increase in gold prices:

Reason 1: Fall in Dollar Index

The relationship between the price of gold and the US Dollar Index (DXY) is often inverse, meaning that when one goes up, the other tends to go down, and vice versa. The Dollar Index has fallen in recent months. In March, it even touched 102.5 levels. But why does it have an inverse relationship? Let us understand.

Gold is denominated in US dollars on global markets. Therefore, when the US dollar strengthens against other currencies, the price of gold tends to decrease in dollar terms. Conversely, when the US dollar weakens, the price of gold tends to increase. This relationship is because a stronger dollar makes gold more expensive for holders of other currencies, leading to decreased demand and lower prices while a weaker dollar makes gold relatively cheaper and increases demand, pushing prices higher.

Reason 2: Interest Rate Cut Expectation by the Fed

It is expected that the Federal Reserve will announce the first interest rate cut in June this year. Gold typically has an inverse relationship with interest rates. When interest rates are low, the opportunity cost of holding gold (which doesn’t yield interest or dividends) decreases, leading to increased demand and higher prices. Conversely, higher interest rates can reduce the attractiveness of gold as an investment, leading to lower prices. Now, with interest rates expected to go down in the US and also in India, gold prices may continue to rise.

Reason 3: The Chinese Demand

Gold demand in China has been on the rise in recent quarters. The Chinese central bank has been adding substantial quantity of gold to its reserves which is leading to the increase in the gold price in the US and also in India. Not only this, as per reports, a new trend has emerged in China where gold buying is becoming popular among young Chinese.

Before you go

The gold price has been on the rise. It is expected to increase further. However, it is essential to note that gold prices are influenced by a complex interplay of various factors, and prices can be volatile in response to changes in these factors. As a result, predicting gold price movements in the short term can be challenging.

GOLDCeylon | 03.04.2024 | 21.30 Hrs