Value-added tax (VAT)

VAT is payable on the importation of goods, on the supply of goods (including wholesale and retail trade), and on the supply of services in Sri Lanka. Provisions are made for filing returns monthly or quarterly, based on specified criteria. Even where returns can be filed quarterly, the tax payments are required to be made on a monthly basis by a VAT-registered person. Certain specified goods (imports & domestically supplied) and services are exempt.

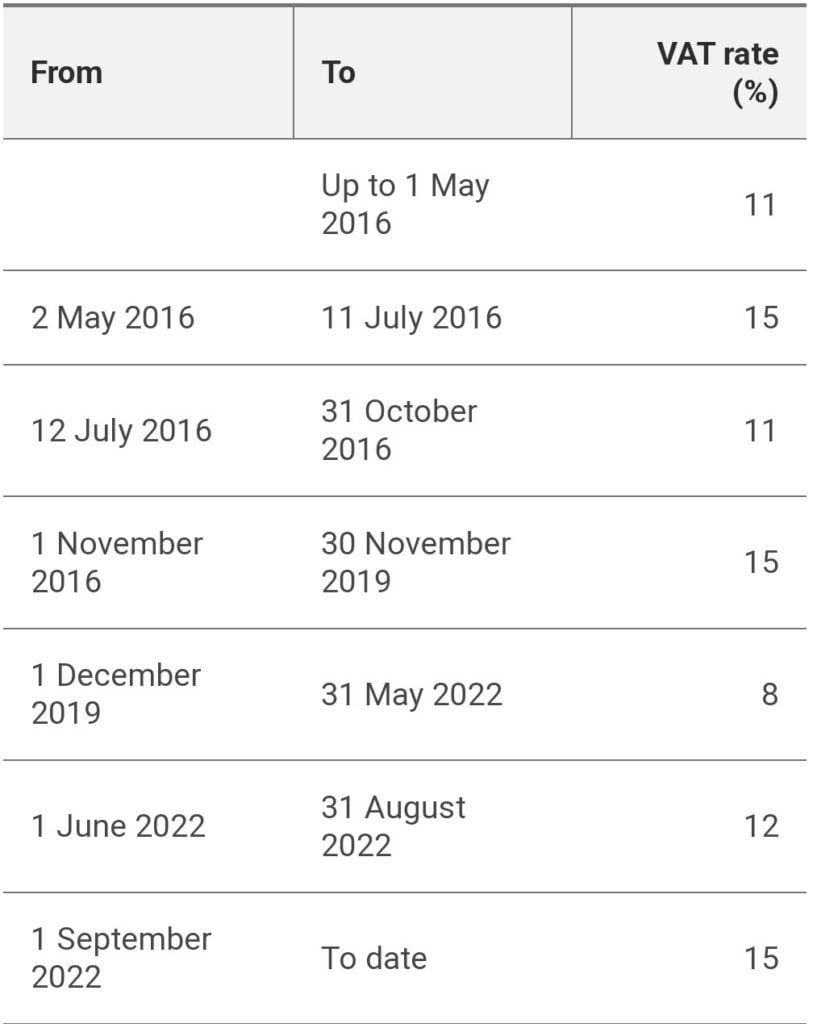

Recent VAT rate changes are prescribed in the following table.

Exports and certain specified international services are zero-rated.

Registration for VAT arises only if the quarterly value of taxable supplies exceeds LKR 20 million or the annual value of taxable supplies exceeds LKR 80 million with effect from 1 October 2020. However, a voluntary registration scheme is available to those who have turnover value of supply less than LKR 20 million for a quarter.

The input tax paid on the imports and supplies of goods (including capital goods) and services used as inputs in a month, and used in the business of making taxable supplies in that month, can be deducted from the tax payable (output tax) on such supplies, subject to a limitation of the lesser of 100% of output tax or the actual input tax paid.

Refunds of excess VAT paid are available to zero-rated supplies and to new businesses registered under Section 22 (7) of the VAT Act. A simplified VAT scheme is in place to relieve zero-rated suppliers and other qualified suppliers from the burden of paying input VAT, thereby obviating the need for the issue of refunds.

TAX HIKE: Sri Lanka to increase VAT to 18% in 2024

Various tax based enhancing and developmental tax policy proposals have been implemented from the month of June 2022 for the state financial stability based on the income with the objective of ensuring loan sustainability and as a result of that, the state tax revenue of the first 09 months of 2023 has been escalated by 51% compared to the year 2022.

However, tax collection targets agreed with the International Monetary Fund have not yet been accomplished. Accordingly, the Cabinet of Ministers granted approval to escalate the value added tax rate up to 18% with effect from 01.01.2024, impose the said tax on certain goods and services to which the value added tax is not yet applicable and implement some of new tax proposals with effect from 01.01.2024 including the imposition of that tax to enable accomplishment of tax revenue and primary balance targets as agreed with the International Monetary Fund.

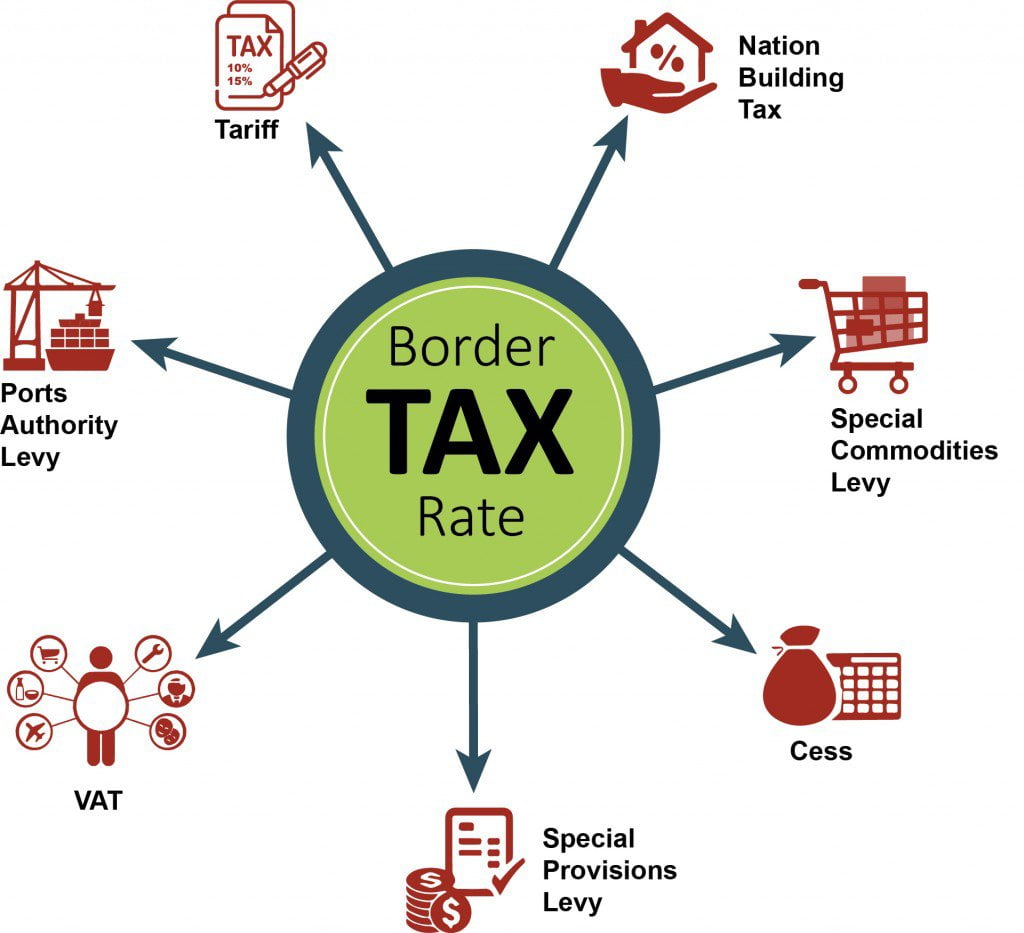

Customs Duties

Customs duty is levied on the value for customs duty (i.e. transaction value). World Trade Organization (WTO) rules on customs valuations are implemented. Sri Lanka has a simplified three-tier tariff structure. The rates are published in the government gazettes. The current rates are 10% and 15% (0% applies to few goods).

Special Commodity Levy

Special Commodity Levy is imposed on certain commodity items at the rate specified by the Minister by order published in the gazette at the point of importation of such commodities. The collection of Special Commodity Levy is undertaken by the Director General of Customs.

Special Commodity Levy is a composite levy, and no other tax, duty, levy, cess, or other charge is imposed in terms of any other laws specified as applicable in respect of the commodities specified in any such order.

Excise duties

Excise duties and special excise levies are charged on tobacco, cigarettes, liquor, motor vehicles, selected petroleum products, paints, air conditioners, dishwashers, household washing machines, and other products at various rates and at unit rates.

Stamp duty

Stamp duty is payable on specified instruments and documents at rates prescribed in the Gazette.

@goldceylon

Published by : www.goldceylon.lk